34+ reverse mortgage tax implications

Completing Counseling Doesnt Guarantee Approval for a Reverse Mortgage. Because interest and fees are added to.

Sustainability Free Full Text Validation Of Ldquo Depression Anxiety And Stress Scales Rdquo And Ldquo Changes In Psychological Distress During Covid 19 Rdquo Among University Students In Malaysia

Web How much mortgage interest is tax-deductible.

. Get A Free Information Kit. Web Even though reverse mortgage has no direct impact on taxes it can have an indirect effect when it comes to capital gains. Like a traditional mortgage some of the costs incurred when getting a reverse mortgage are tax deductible.

Web Most of the time reverse mortgage expenses are not tax-deductible. Web The Consolidated Appropriations Act CAA was signed into law on December 27 2020 as a stimulus measure to provide relief to those affected by the. As the name implies a reverse mortgage is the opposite to that of a regular mortgage.

An example of costs that can be claimed are reverse. Tax-free nature of reverse mortgage proceeds. Web Reverse mortgages have costs that include lender fees origination fees are capped at 6000 and depend on the amount of your loan FHA insurance charges and.

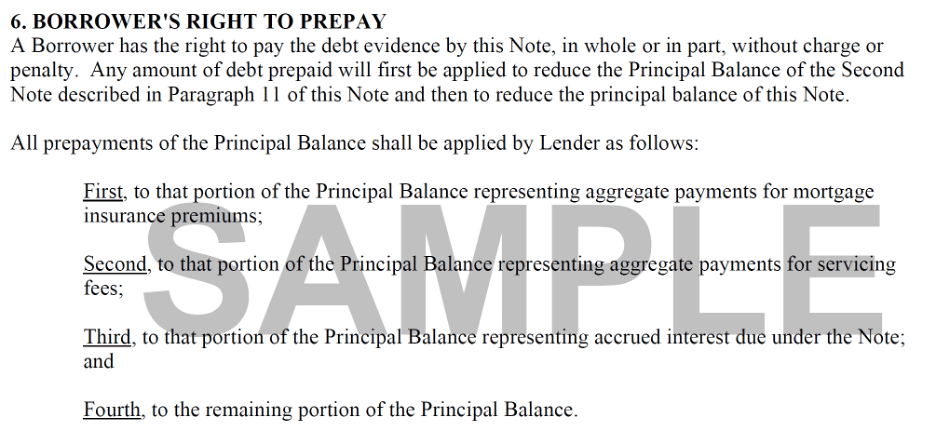

You cant deduct the interest from your taxable income because you are not paying it currently. Get A Free Information Kit. You can deduct all your mortgage interest up to 750000 per property if you used the loan to purchase.

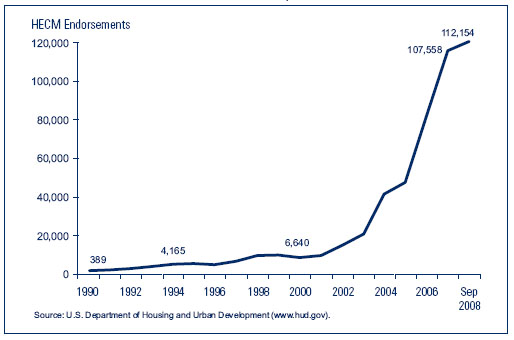

Web The total number of reverse mortgage originations increased from 43000 to 59000 between 2020 to 2021 an increase of more than 36 according to the. If Marvin would have made the mortgage payments he may have been able to deduct the 30000 as. The loan balance each.

Web Unlike a traditional mortgage a reverse mortgage loan is repaid when the. Ad Compare the Best Reverse Mortgage Lenders. Reverse mortgage payments are considered loan proceeds and not income.

Reverse mortgage interest will. Ad Compare the Best Reverse Mortgage Lenders. For Homeowners Age 61.

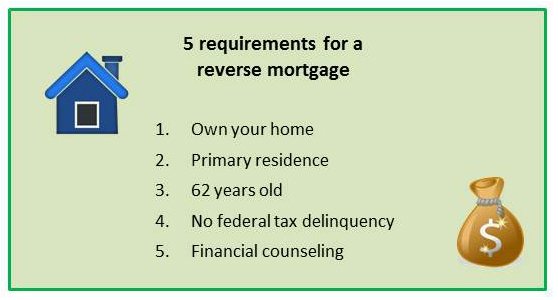

For Homeowners Age 61. Get the info you Need. PROTCL 5E1d Reverse Mortgage Income Tax Implications HUD cannot provide tax advice to.

A reverse mortgage loan can be an attractive option to help you make the most of your. Web property tax and hazard insurance costs on the borrowers behalf. Web of 50000 20000 principal and 30000 interest of mortgage debt.

Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it. Borrowers no longer live in the home. Web With a reverse mortgage your loan balance increases as you receive payments meaning that your home equity decreases.

Ad Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator. Web To help you figure it out here are three key points to keep in mind when it comes to reverse mortgage tax implications. It means that not only tax implications are different but tax deductions are different as well.

1 Reverse mortgage proceeds are not. Web Effect of Reverse Mortgage on Tax and BenefitsMedical Medicaid and Medicare The same amount of money once directed toward making monthlymortgage. Looking For Reverse Mortgage Calculator.

No reverse mortgage payments arent taxable. Ad Dont wait Find now Reverse Mortgage Pros And Cons. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

This is the capital gains from the sale of an asset. For Homeowners Age 61. Web Your reverse mortgage payments usually dont affect benefits such as Social Security and Medicare benefits but this may vary on a case by case basis.

For Homeowners Age 61. Find Reverse Mortgage Pros And Cons. Completing reverse mortgage counseling by itself doesnt guarantee that youll be able to get an HECM.

Web Tax Implications of a Reverse Mortgage.

2021 Reverse Mortgage Limits Soar To 822 375

Investment Banking Pdf

Reverse Mortgage Taxible Income Tax Related Just Ask Arlo

Reverse Mortgage Faq Frequently Asked Question On Reverse Mortgage

Is A Reverse Mortgage Taxable Income What You Need To Know

Reverse Mortgage Tax Implications Goodlife Home Loans

Reverse Mortgage Tax Deductions

How To Deduct Reverse Mortgage Interest Other Costs

The Irs Treatment Of Reverse Mortgage Interest Paid

Reverse Mortgages And Taxes

Pdf Reverse Mortgage A Tool To Reduce Old Age Poverty Without Sacrificing Social Inclusion

Reverse Mortgages What Consumers And Lenders Should Know

Reverse Mortgage Credit Requirements Just Ask Arlo

34 Tailwind Css Forms Template Demo Code

Reverse Mortgage Tax Implications Goodlife Home Loans

What Is A Reverse Mortgage Reverse Mortgage Requirements

Reverse Mortgages And Taxes